I haven’t done any substantive analysis, but after reading a number of very recent stories from overseas, particularly from the US and Australia, it appears there is a groundswell of increasing concern about the pressure on trucking businesses and the risks this presents to their financial viability.

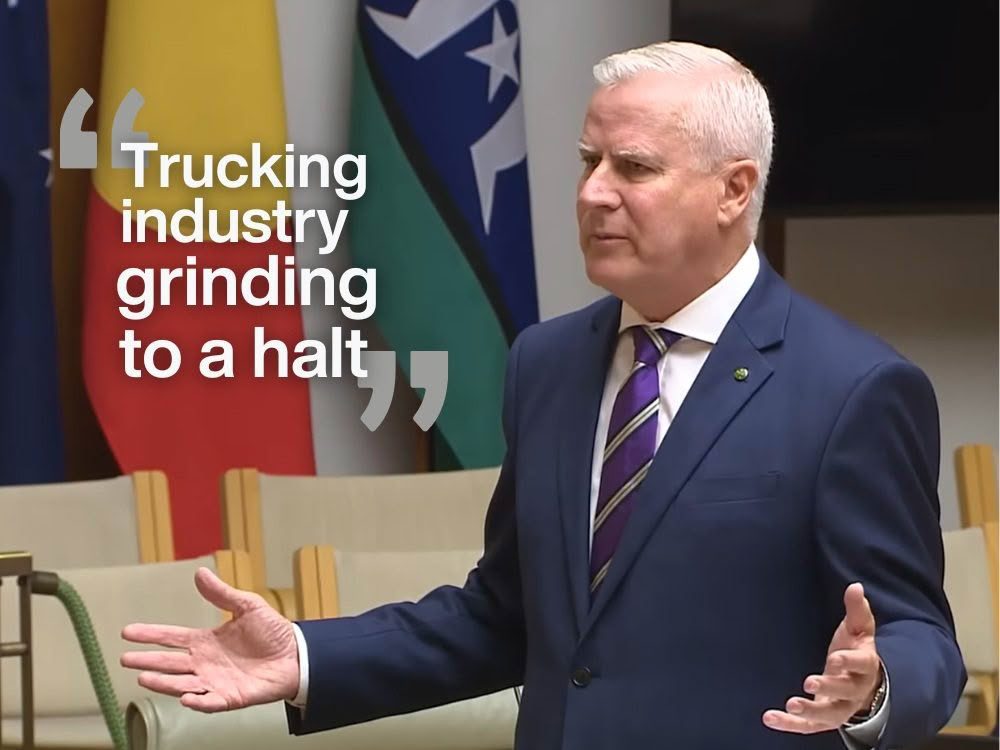

Australian parliamentarian Michael McCormack recently gave a speech about the “Trucking Industry Grinding to a Halt.”

Another story described the pressures on the industry this way:

“The warnings come from operators, industry associations, and analysts who have watched margins compress to unsustainability while costs for fuel, insurance, compliance, and maintenance climb at rates that cannot be passed on to customers in markets where retailers and manufacturers wield pricing power that individual trucking companies cannot match. The result is an industry where firms are closing at accelerating rates, drivers are leaving for less demanding employment, and the trucks that keep Australia functioning are approaching retirement age without replacement capital available.”

Some of the common reasons cited for these increasing pressures include sham contracting in Australia and the use of immigrant drivers.

I am hearing a growing number of similar sentiments expressed in New Zealand. Another contributing factor here is a widening disparity in the integrity and quality of services. Some operators are astonished at how other operators (typically new entrants) can offer such cheap rates. Many would probably agree that we could simply substitute New Zealand for Australia in the story above, and it would accurately describe our current situation.

This week I raised the issue with NZTA’s Chief Executive, and he agreed. It was reassuring to see that the issue is on NZTA’s radar, given they are the regulator of the system and, in my view, have a key role to play.

Throughout its history, the transport industry has been exceptionally well served by numerous leaders, visionaries, and innovators, whether through retrofitting and deploying new technologies such as telematics in trucks, designing innovative vehicle configurations, or investing in their people.

I could give endless examples, and much of this innovation continues. However, what concerns me, given the widening disparities and ongoing challenging economic conditions, is that we may lose some of this leadership.

I’m not criticising those who feel discouraged; in fact, I think their feelings are justified, and I’m sympathetic to their position. But more than ever, I’m hearing operators say things along the lines of: “Why should I do all this when the operator down the road does nothing?”

The risk and impact of losing this leadership should not be underestimated. This issue is also potentially being exacerbated by our regulator appearing to be more risk‑averse – but that’s a story for another time.

It’s also another reason we must be cautious about simply lifting and shifting approaches from other jurisdictions.

The issue, and potential remedies, to the pressure on transport companies and the disparities among them is complex. This is best demonstrated by the fact that despite the countries mentioned above having very different regulatory settings, we are all experiencing similar concerns.

For me, the biggest challenge is the market.

Some may find this analogy unfair, but I compare it to what’s happened in the taxi industry in recent years. Disruptive business models like Uber have had massive impacts on that sector. Ultimately, the regulatory framework was relaxed; some argue that service quality has declined and risks to public safety have increased. But the fact remains that nowadays most people “Uber,” and to me that is the strongest indication that the change has been considered a success overall.

By and large, people place a high priority on price. While in some cases it may be obvious that a business is poorly run or poorly managed, in many others that is much less apparent – so the supplier with the cheaper rate wins. This exacerbates “the race to the bottom.”

There is no silver bullet to these issues. Mechanisms like chain of responsibility and NZTA’s goods service licence regime have had little impact on maintaining a level playing field, although NZTA’s latest regulatory restructure has been designed to address some of these concerns.

Some of our members have excellent clients and customers who are willing to pay for quality service – but these are the exceptions, not the rule, and I fear that segment may shrink over time.

It is important that we improve our ability to influence the market, as that is key to a brighter future. We cannot afford a growing market that drives a race to the bottom.